The Biden administration has set a bold target for reducing U.S. greenhouse gas emissions and has proposed a $2 trillion infrastructure plan to help achieve it. As part of its efforts, the Department of Energy (DOE) is gearing up to offer $40 billion in loans and loan guarantees to deploy large-scale energy infrastructure projects.

How will DOE select projects that promise great impact and cut emissions? To answer this question, Jigar Shah will kick off this month’s virtual Energy Efficiency Finance Forum. You may know Shah as the former co-host of the Energy Gang podcast and co-founder of Generate Capital, but he recently joined the Biden administration as director of DOE’s Loan Programs Office (LPO).

In his keynote address, Shah will discuss strategies and partnerships that could open the LPO's loan capital to energy efficiency initiatives. Attendees will learn why this federal portfolio has historically not funded efficiency projects and what can be done to change that.

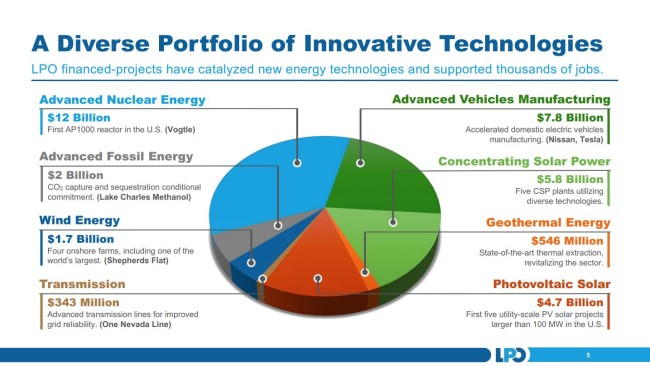

Source: DOE LPO

As a sneak peak, I recently chatted with Shah about his new role at DOE. Below are excerpts from the conversation.

What are your goals for the LPO?

My goal is for LPO to serve as a bridge to bankability for technologies that can have a big impact. We want the projects we finance to serve as a jumping off point for commercial lenders to come in so we can meet what the science is saying we need to achieve to reduce harmful emissions and provide more equitable access to this energy transition.

What is the biggest challenge for the LPO in funding energy efficiency projects?

In general, most energy efficiency projects are small and so very few people think of us as a way to aggregate many small projects into one large financing. Separately, it is easier to read the meter on something that generates energy versus reading the meter on “negawatts”—the watts that were saved because of efficiency or conservation.

The good news is that the LPO can offer loans with longer durations than most commercial lenders are willing to offer. And because our goal is to advance the energy transition in a big way, we’re engaging with many of the energy efficiency loan platforms, taking the time to develop better ways of financing efficiency projects.

What exactly makes for a great loan candidate?

A great candidate for LPO’s Innovative Energy Loan Guarantee Program has technology that has been demonstrated to work but has never been deployed at commercial scale. Such candidates have shown that customers have an appetite for their approach. They also have some sense of how to keep the assets performing well for the life of our loan.

What role could LPO-financed energy efficiency projects play in supporting the administration’s equity and diversity goals?

For far too long, communities of color and low-income communities have paid for essential appliances and transportation at payday lending interest rates that are far higher than conventional loan products. We can review actual loan repayment rates and provide these communities access to debt capital at competitive rates. LPO can work with states, cities, utilities, companies, tribal governments, and nonprofits to offer access to energy efficiency products at an affordable cost, and do so at a scale that really gives all Americans access to the latest technology.

For more information, email the LPO to request a pre-application consultation.